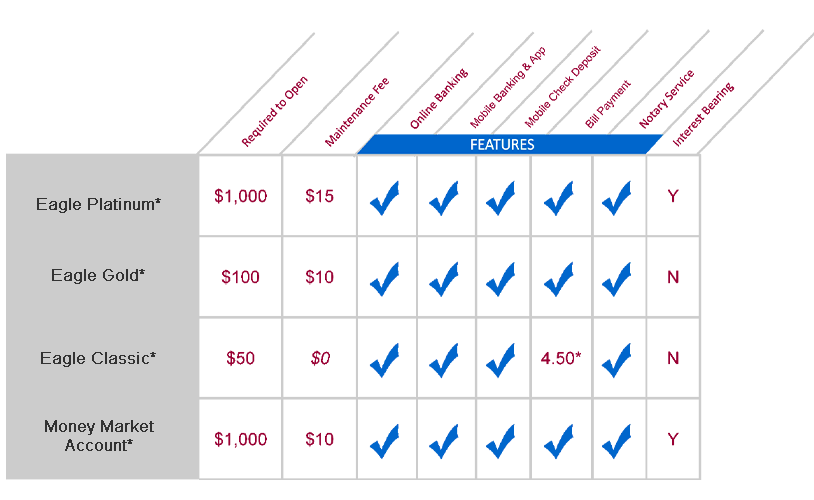

Personal Checking

Get rewarded for doing what you’ve always done! Our checking accounts give you the flexibility to earn discounts on your monthly maintenance fee for simply doing the same things you’ve always done, such as using your debit/ATM card and depositing checks using our convenient Mobile Check Deposit. If the possibility of a low maintenance fee and convenient access to your account is what you’re searching for, then we’ve got the perfect match for you.

Stop in to meet with one of our personal bankers to see which checking account will best meet your needs.

*See account description below for details

Eagle Platinum

If you’re looking for a checking account that provides convenience and security while earning interest, then look no further than our Eagle Platinum account. This account is ideal for those ready to tackle their daily financial tasks with ease.

- $1,000.00 minimum deposit required to open account

- No minimum daily balance required to earn interest – Interest compounded monthly. Credited to your account on the last business day of your monthly statement cycle. At our discretion we may change rates. The annual percentage yield (APY) may change. Account fees may reduce earnings. Accrued interest is paid when the account is closed.

- $15.00 monthly maintenance fee, imposed per statement cycle – Fee waived with $2,500.00 minimum daily balance or with a minimum of $50,000.00 in aggregated daily personal deposit balances. Maintenance fee waived for first statement cycle, new accounts only.

- Receive credit back on first 8 non-BWD ATM withdrawal fees, per cycle

- BWD Debit Card – $5.00 semi-annual fee waived

- Fee waived on first single order of checks, new accounts only

- A $2.00 discount for receiving e-Statements will apply, if applicable

- 25% discount on annual safe deposit box rental, requires auto payment

- Online Banking | Mobile Banking | Mobile Check Deposit | Telephone Banking | e-Statements | Bill Payment

Eagle Gold

The Eagle Gold account is ideal for those who want the basics when it comes to their checking. This non-interest bearing account provides the convenience needed to breeze through your day without missing a beat.

- $100.00 minimum deposit required to open account

- $10.00 monthly maintenance fee, imposed per statement cycle. The following per cycle discounts will apply and will be credited to your account on the last day of your statement cycle: $6.00 discount for 20 or more debit card transactions (excludes ATM withdrawals), $2.00 discount for receiving e-Statements, $2.00 discount for Direct/Mobile deposits over $400.00. Maintenance fee waived for first statement cycle, new accounts only.

Other Features –

- Receive credit back on first 4 non-BWD ATM withdrawal fees, per cycle

- BWD Debit Card – $5.00 semi-annual fee per account assessed May & Nov

- Fee waived on first single order of checks, new accounts only

- Online Banking | Mobile Banking | Mobile Check Deposit | Telephone Banking | e-Statements | Bill Payment

Eagle Classic

Our Eagle Classic checking account is perfect for high school and college students or those with new careers. It allows you to go about your day without the worry of monthly maintenance fees or piles of paper statements.

- $50.00 minimum deposit required to open account

- e-Statements – required (If you require a paper statement to be sent, a $10.00 per statement fee will apply.)

- BWD Debit Card – $5.00 semi-annual fee per account assessed May & Nov

- Bill Payment available at $4.50 per month, fee waived with direct deposit

- Online Banking | Mobile Banking | Mobile Check Deposit | Telephone Banking

Money Market Account

Our Money Market Account is perfect for those looking to gain a competitive interest on their deposits while keeping their money easily accessible.

- $1,000.00 minimum deposit required to open

- $750.00 minimum daily balance to earn interest – Interest compounded monthly. Credited to your account on the last business day of the month. At our discretion we may change rates. The annual percentage yield (APY) may change. Account fees may reduce earnings. Accrued interest is paid when the account is closed.

- $10.00 monthly maintenance fee, imposed per statement cycle- Fee waived with $1,000.00 minimum daily balance

- $5.00 per check, draft, ACH, or third party payment, in excess of three per statement cycle, regardless of balance

- No limit for “in person” transactions

- Check order charges will apply, no charge for deposit tickets

- Online Banking | Mobile Banking | Mobile Check Deposit | Telephone Banking | e-Statements