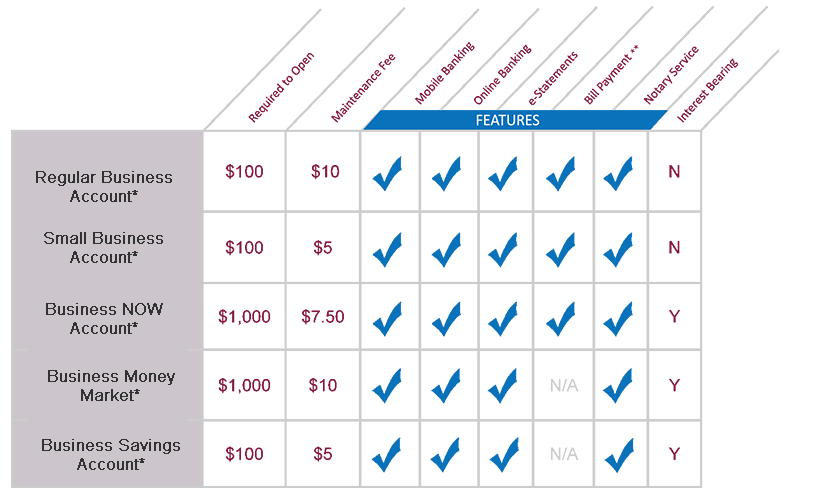

Business Deposit Accounts

Our business services are specially designed to help you and your business travel smoothly down the road to success. With the right financial tools and our personalized service, you can rest assure that your business accounts are safe and secure. Stop in to meet with one of our representatives to see which business account will best meet your needs.

* See account description for details

**Bill Payment is subject to qualifications. Additional fees may apply.

Bank of Wisconsin Dells Business Debit Card

This card has all the great features of a credit card; flexibility, worldwide acceptance, and safety. It functions like a check, with purchases or ATM withdrawals taken directly from your checking account.

It’s easy to use

To make a purchase, just present your BWD Debit Card. Your purchase amount will automatically be deducted from your checking account. Every transaction will appear on your monthly statement with the detailed information you need: amounts, dates and locations.

It’s safe

BWD Check Card is safer than carrying cash and easier than carrying a checkbook. If your card is lost or stolen, you are not liable for unauthorized purchases. Just call 866-558-2091 as soon as you realized your card is missing.

Regular Business Account

Our Regular Business checking is a non-interest bearing account designed for those in need of quality options as well as services. Your business checking becomes simple and convenient.

- $100.00 minimum deposit required to open account

- $10.00 monthly maintenance fee

- $0.15 per debit fee

- $0.15 per ACH debit fee

- $0.20 per credit fee

- $0.10 per ACH credit fee

- $0.08 per transit item deposited fee

- $18.00 per CD with imaged statement

- Earnings credit calculated on average available balance

Small Business Account

This is a non-interest bearing account designed specifically for businesses that experience low transaction activity.

- $100.00 minimum deposit required to open account

- $5.00 monthly maintenance fee – Fee waived with $1,000.00 minimum daily balance

- $0.15 per debit fee over 40

- $0.15 per ACH debit fee over 20

- $0.20 per credit fee over 10

- $0.10 per ACH credit fee over 10

- $0.08 per transit item deposited over 120

Business NOW Account

Our Business NOW account combines the benefits of a checking account with the earning power of a savings account. Unincorporated sole proprietors are eligible for Business NOW accounts.

- $1,000.00 minimum deposit required to open account

- $750.00 minimum daily balance to earn interest – Interest compounded monthly. Credited to your account on the last business day of the month. At our discretion we may change rates. The annual percentage yield (APY) may change. Account fees may reduce earnings. Accrued interest is paid when the account is closed.

- Unlimited check writing

- $7.50 monthly maintenance fee – Fee waived with $2,500.00 minimum daily balance

- $0.15 per debit fee – $2,500.00 minimum daily balance waives this fee for first 40 debits

- $0.15 per ACH debit fee – $2,500.00 minimum daily balance waives this fee for first 20 debits

- $0.20 per credit fee – $2,500.00 minimum daily balance waives this fee for first 20 credits

- $0.10 per ACH credit fee- $2,500.00 minimum daily balance waives this fee for first 10 credits

- $0.08 per transit item deposited fee – $2,500.00 minimum daily balance waives this fee for the first 120 items

Business Money Market Account

Our Business Money Market Account is perfect for those looking to gain a competitive interest on deposits while keeping their money easily accessible.

- $1,000.00 minimum deposit required to open account

- $750.00 minimum daily balance to earn interest – Interest compounded monthly. Credited to your account on the last business day of the month. At our discretion we may change rates. The annual percentage yield (APY) may change. Account fees may reduce earnings. Accrued interest is paid when the account is closed.

- $10.00 monthly maintenance fee – Fee waived with $1,000.00 minimum daily balance

- $5.00 per debit fee – fee waived on first 3 checks, ACH or payment to third-party as well as all in-person transactions

- $0.10 per ACH credit fee over 10

- $0.08 per transit item deposited fee over 20

- There is no limit for “in person” transactions

Business Savings Account

Our Business Savings is an interest-bearing account with low balance requirements and little-to-no monthly maintenance fees.

- $100.00 minimum deposit required to open account

- $5.00 monthly maintenance fee – Fee waived with $500.00 minimum daily balance

- $0.50 per withdrawal in excess of 3 per month ( includes automatic transfers )

- No minimum balance required to earn interest – Interest compounded quarterly. Credited to your account the last day of March, June, September, and December. At our discretion we may change the rates. The interest rate and annual percentage yield (APY) may change. Account fees may reduce earnings. Accrued interest will be paid when the account is closed.

For further information, contact one of our Personal Bankers at (608) 253-1111.

Click here for important information about procedures for opening or changing an account.